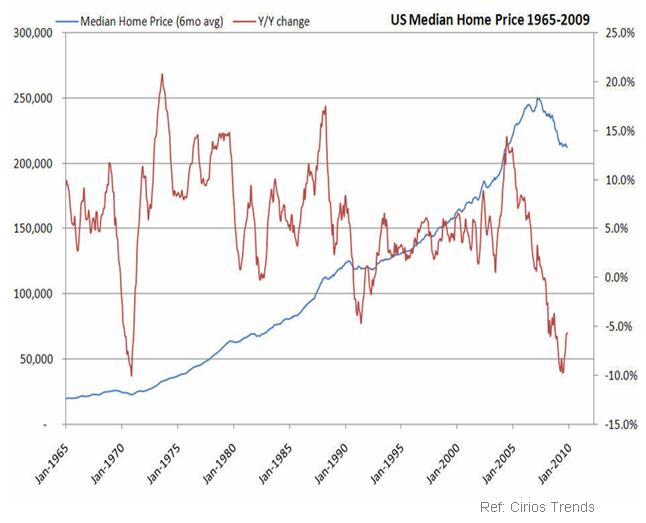

In the last 30 years, although sales of existing homes have gone up and down like a Roller Coaster, prices have increased at a steady pace.

Below is an explanation of when & why prices went up..and then went down....and up again.

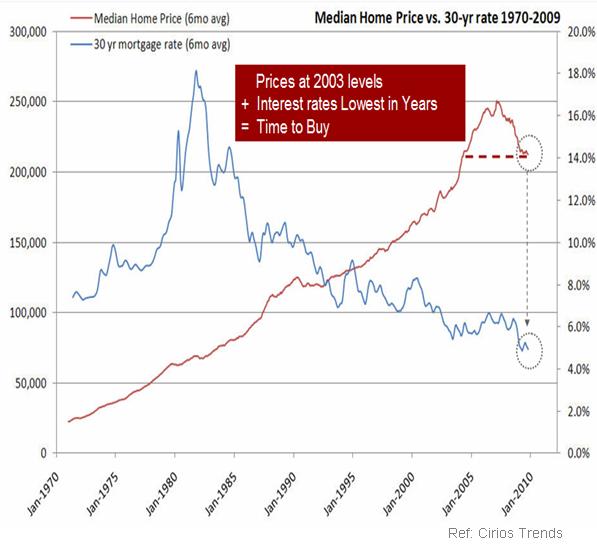

1979 - 1982: In October, 1979, Fed Chairman, Paul Volcker, restricted the growth of the money supply, which in turn, caused interest rates to skyrocket.

Interest rates rose from 12.5% (Sept. 1979) to the peak of 17.48% in 1982!

Inflation plagued the economy and unemployment rose from 5.9% in 1979 to 10.8% in December 1982, which put the U.S. in a deep recession. EXISTING HOME SALES DROP 61%!

1982 - 1987: Congress stepped in and deregulated Savings & Loans. This gave them the power to invest directly in service corporations, make real estate loans without regard to the geographical location of the loan, and authorized them to hold up to 40 percent of their assets as commercial real estate loans. REAL ESTATE BOOMS!!!

1988 - 1992: The Savings & Loan Crisis HITS. 747 S&Ls in the United States FAIL. REMEMBER THE "KEATING FIVE"?

President Bush Sr. enacts the S&L Bailout Plan. SOUND FAMILIAR?The ultimate cost of the S&L crisis is estimated to have totaled around $160.1 billion, about $124.6 billion of which was directly paid for by the U.S. taxpayer. SOUND FAMILIAR?

The accompanying slowdown in the Finance Industry and the Real Estate Market may have been a contributing cause of the 1990-1991 economic recession. EXISTING HOME SALES DROP 25%!

1993 - 2000: Interest rates drop, fluctuating from 8.12% in 1993 to 8.32% in 2002. EXISTING HOME SALES ARE ON THE RISE AND PRICES INCREASE AT A STEADY RATE

CAN YOU SAY .COM? Tech Stock becomes KING. Companies see their stock price shoot up when they add .com after their name. Life is GOOD....for a while anyway.

The dot-com bubble burst on March 10, 2000. The crash wiped out $5 trillion in market value of technology companies from March 2000 to October 2000.

2001 - 2007: Enter Alan Greenspan. In an effort to bring us out of a recession after the .com BUST and 9/11, Greenspan dramatically eases credit.

Baby Boomers decide that the stock market won't provide them with sufficient assets to retire. They take advantage of real estate markets and low down payments to speculate in residential real estate.

Investors step in, buy up as much as possible and lie about owners occupying homes.

Buyers overbid because they thought they could FLIP the house and make a killing.

Lenders provide loans to Buyers who could not qualify. THE REAL ESTATE MARKET GOES CRAZY!

HOMES SELL LIKE HOTCAKES AND PRICES ARE DRIVEN UP TO RECORD LEVELS!

It seems that this market will last forever and we will all be rich!

2007 - 2009: Oops! The BUBBLE BURSTS. It had to end, right?

The Bad News: HISTORY REPEATS ITSELF.

The Good News: HISTORY REPEATS ITSELF.

With the DRAMATIC increase in prices from 2001 - 2007, the Market HAD TO correct itself...DRAMATICALLY!

Home prices have rolled back to 2003 levels and as you can see by the chart below, interest rates are still at record lows.